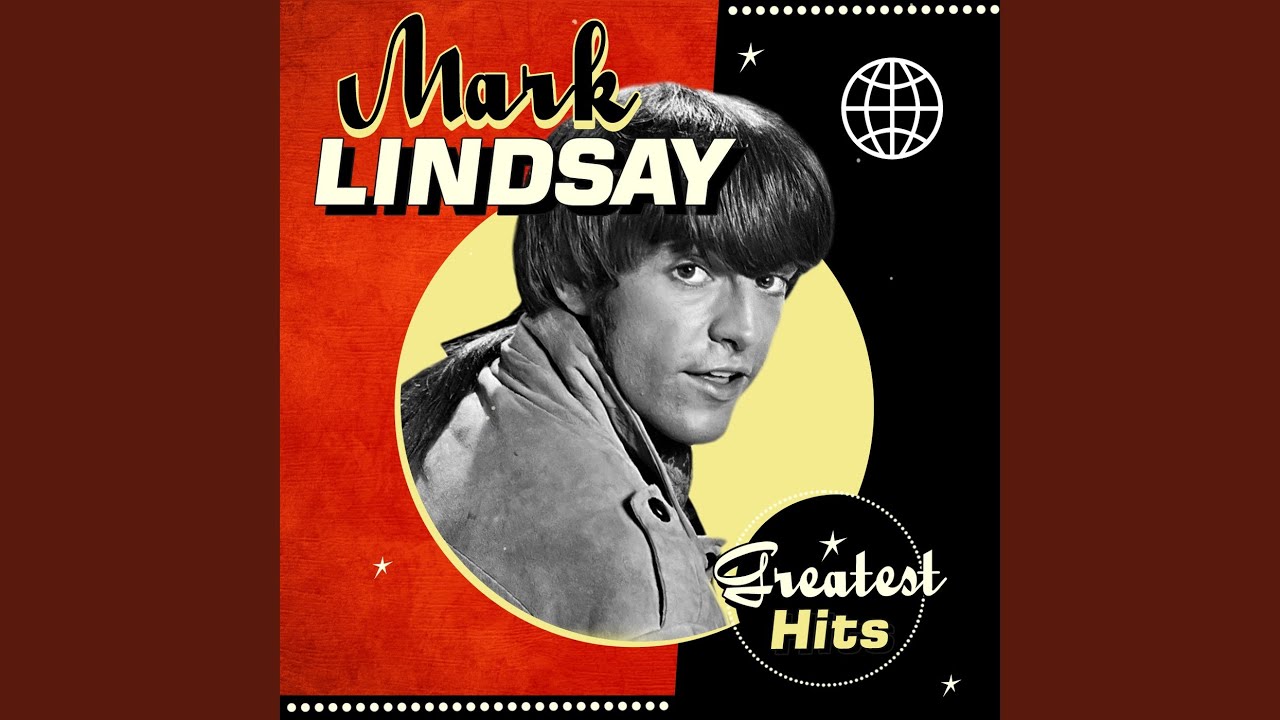

Chairman Joe Biden said he was extending the fresh moratorium of all government education loan repayments from stop away from August supply consumers additional time “discover right back on the legs after two of the most difficult decades which country has actually ever before encountered.” | Getty / Getty Photos

The fresh Biden management for the Wednesday moved to expunge the non-payments off countless federal education loan consumers which dropped about to your money up until the pandemic, as the White Home officially expose a four-month expansion of your stop into the month-to-month mortgage money and you can interest.

This new extension up until Aug. 30 is actually much faster than of many Democrats had requested. Many progressive and much more centrist Democrats got urged the brand new management to keep the brand new pandemic save having individuals up until at least the conclusion the season, which may prevent having money restart ahead of the fresh November midterm elections.

“One more time will help individuals in the achieving better financial protection and you may keep the Service regarding Education’s jobs to continue improving beginner mortgage software,” Biden said, incorporating his government would provide “more flexibilities and you can service for all consumers.”

The latest administration will allow “all individuals that have paused finance for an effective ‘new start’ toward repayment by detatching brand new impact off delinquency and you may standard and you can allowing them to reenter cost from inside the a beneficial position,” the education Service told you within the yet another declaration towards the Wednesday.

POLITICO earliest reported into the October the Biden government was lookin on plans to instantly remove an incredible number of borrowers off default on their federal figuratively speaking, which officials got internally branded “Process Fresh Initiate.”Management officials was basically performing from info on that proposal to have days. The fresh new deliberations was challenging, to some extent, by the  how the Studies Institution intentions to fund the application, considering multiple somebody regularly the newest discussions.

how the Studies Institution intentions to fund the application, considering multiple somebody regularly the newest discussions.

A degree Institution authoritative verified in order to POLITICO your institution create end up being automatically erasing the non-payments of all individuals included in the fresh new pandemic-relevant stop.

Roughly 8 billion borrowers can be found in standard to your those types of federal loans, predicated on previously released research regarding the Studies Company.

Several Senate Democrats, provided because of the Sens. Age Warren of Massachusetts and you will Raphael Warnock of Georgia, a year ago named with the government to remove non-payments out of all the government student education loans. Now, Sen. Patty Murray (D-Wash.), new sofa of one’s Senate knowledge committee, and additionally recommended the training Department for taking that step.

Lawmakers contended the education Service contains the power to do it while the CARES Work allowed defaulted individuals to help you amount the brand new pandemic-frozen payments towards the nine months out of payments that will be generally necessary for a borrower to create the funds regarding standard thanks to a method called “rehab.”

During the an announcement, President Joe Biden said he was extending the brand new moratorium of all federal education loan costs through the end regarding August giving consumers more time “to acquire right back to their feet once a couple of most difficult many years it country features previously encountered

Individuals constantly need submit documents with a debt collection business to begin with you to process, but Democrats are pressing new government so you can nix you to needs-it appears the education Company plans to perform.

Including individuals just who owe federal student loans which can be physically kept of the Education Institution together with individuals who defaulted to the federally-protected student education loans made by private lenders

New department intentions to discharge more info about how precisely the application will work from the “future months,” the fresh new department official said.

Biden mentioned that in spite of the power of financial data recovery, “we have been however recovering from the brand new pandemic while the unprecedented financial disturbance they brought about.”